PMS Decoded.

Everything you need to know before you invest, in simple language. At Grey Sky, we don’t hide behind jargon. We believe clarity is the highest form of respect and rebellion. This is not a legal maze; it’s your navigation deck.

At Grey Sky, we don’t hide behind jargon. We believe clarity is the highest form of respect and rebellion. This is not a legal maze; it’s your navigation deck. Here’s everything you’d want to know before trusting anyone with your money — decoded in plain language.

1. The Basics

Q1. What exactly is a PMS? A PMS is professional money management, without the herd mentality. Your assets stay in your name, managed by SEBI-registered professionals following a transparent, rule-based process. It is not do it yourself and the portfolio is managed by fund managers under power of attorney.

Q2. How is PMS different from a mutual fund? In a mutual fund, you buy units of a common pool. In a PMS, you own every stock directly, see every trade, and decide when to add or withdraw. You get message on every activity happening in your Dmat account from custodian. It’s personal, precise, and designed for investors who outgrow cookie-cutter products.

Q3. Who is PMS meant for? For investors ready to move from saving to stewardship — founders, professionals, and families who value transparency, data, and long-term discipline. (And yes, SEBI requires a minimum ₹50 lakh investment.)

2. Regulation, Eligibility & Structure

Q4. Who regulates PMS in India? The Securities and Exchange Board of India (SEBI) — under the SEBI (Portfolio Managers) Regulations 2020. The Association of Portfolio Managers in India (APMI) works with SEBI to set reporting standards and industry benchmarks.

Q5. Who holds my securities? You do — in your own demat account with an independent SEBI-registered custodian. We manage the portfolio, not the ownership.

Q6. Can NRIs invest? Yes. Through NRE/NRO accounts in compliance with FEMA and custodian norms. We handle the red tape so you can focus on returns.

3. Fees, Alignment & Transparency

Q7. How do your fees work? Most managers get paid even when you don’t. We thought that was broken. So we flipped it:

- Minimal fixed fee of 0.75% p.a. paid quarterly.

- Performance fee of 20% only on alpha above the benchmark or a high hurdle rate of 12%, as selected by investor.

- No performance fee in negative years.

- High-watermark applies. You don't pay a fee twice for the same performance.

If we don’t outperform, we don’t earn extra. Simple as that. This is one of the most investor friendly fee structure in PMS industry with low fixed and high hurdle rate. Read our detailed fee explainer here

Q8. What costs are involved? Apart from management fees — brokerage, fund accounting, custodian, order management system and audit costs as per actuals. All shown line-by-line in your statement. No small print, no surprises.

Q9. How transparent is reporting? You’ll always know what you own, why you own it, and how it’s doing. Monthly statements, quarterly reports, and annual summaries — clean, digital, detailed.

4. Investment Philosophy & Process

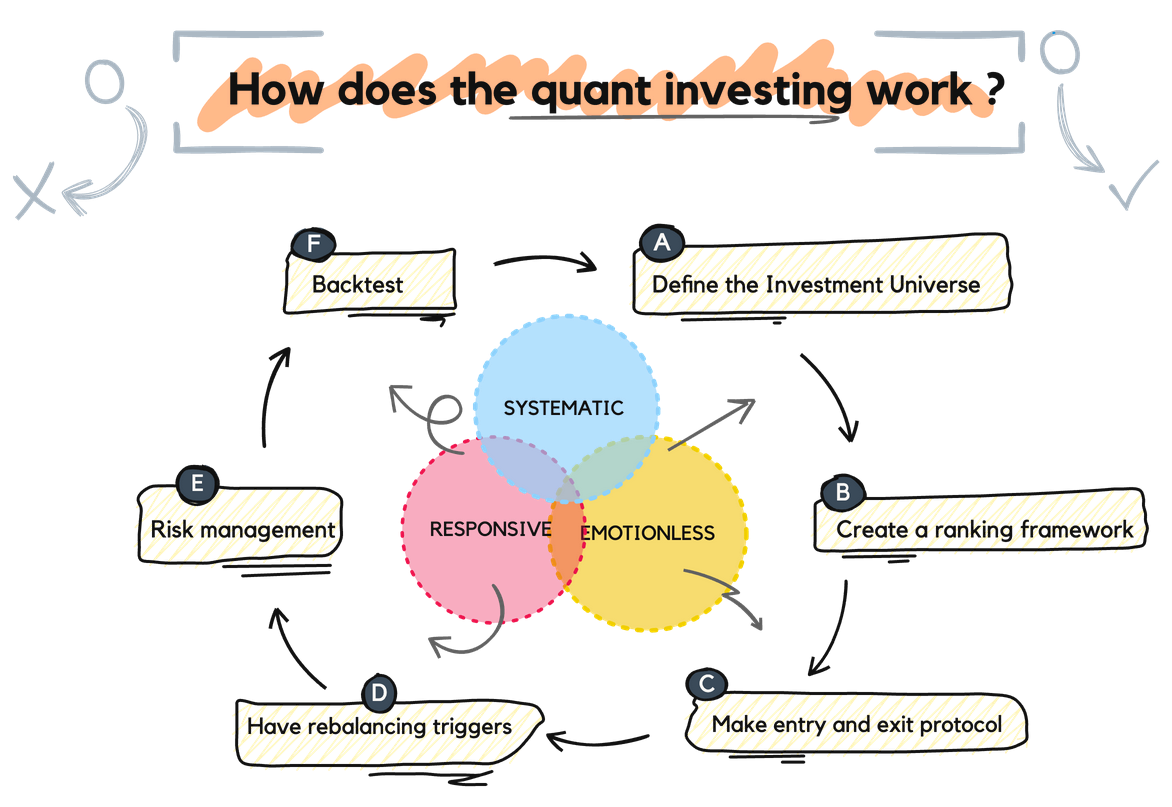

Q10. How do you invest? We don’t chase tips or time markets. We have built systems that respond to truth — price. Our models measure momentum, volatility, and trend strength across equities, gold and cash. We call it clarity in motion — data-driven adaptability with discipline at its core. This form of investing is popularly called Quant investing.

To know more about the process, please download the product presentation.

Q11. Can I approve every trade? If you choose a non-discretionary account, yes. We are only offering discretionary — so decisions happen in real time, without waiting for consent forms. Speed and structure over hesitation. Fund manager operates under PoA. Execution of trade is responsibility of PMS.

Q12. What’s your benchmark? We are multi asset class PMS. However, benchmark we have chosen is Nifty 50 TRI, which means we are comparing our performance against pure equity product, which has given higher return than multi asset class benchmarks over long term.

Our goal isn’t just to beat it. It’s to stay ahead of it through every cycle.

5. Risk, Liquidity & Exit

Q13. What are the risks? Markets swing, sometimes wildly. This risk is measured through volatility in the portfolio. We manage risk through diversification, cash toggles and defined exit signals. But no system removes risk — it only makes it measurable. If someone promises zero drawdowns, run.

We not only work towards generating alpha but higher return per unit of risk taken, which is measured through Sharpe Ratio ( return divided by volatility)

Q14. Can I withdraw or exit? Yes, anytime as per your PMS agreement. There is no exit load. No lock-ins, no gates. It is recommended to take a 3 year view, while investing in equity markets.

Q15. What if something goes wrong? We fix it fast. If still unresolved, SEBI’s SCORES platform is your escalation path. We believe accountability isn’t compliance — it’s culture.

6. Taxes & Reporting

Q16. How are PMS gains taxed? Profits are taxed in your hands — long-term or short-term depending on holding period. Dividends are taxable too. We share detailed tax statements so your CA sleeps well.

Q17. How often will I hear from you? Regular updates, monthly statements, quarterly notes. And yes — if the market shakes, you’ll hear from us before you need to ask. Its not a mass offering and we would know all of your names. You are more than welcome to reach out to us in event of any doubt or just to understand market better.

7. Compliance, Custody & Rights

Q18. Is Grey Sky Capital regulated? Yes. We’re a SEBI-registered Portfolio Manager, fully compliant with all regulatory, audit, and disclosure norms. Assets are segregated, independently custodian, and reported under SEBI & APMI frameworks. There are less than 500 PMS active in India, so its not easy to get PMS License and is tightly regulated by SEBI.

Q19. Where can I view your Investor Charter and complaint disclosures? On our website, under Regulatory Disclosures. Updated monthly, exactly as SEBI requires — and sometimes sooner.

Q20. What if there’s a change in control? You’ll know first. SEBI mandates disclosure and exit rights — and we honour both, no questions asked.

8. Philosophy & People

Q21. Why “Grey Sky”? Because markets aren’t black or white — they live in the grey. And above every grey sky lies clarity, if you rise high enough to see it. That’s our north star: discipline that sees through uncertainty. Read more about why the name here.

Q22. What makes you different? We don’t optimise for AUM or attention. We optimise for reliability, integrity, and performance. Grey Sky follows a relatively new theme in India — quant-based investing — already proven globally for its superior returns and risk control.

Our edge comes from having built one of the most sophisticated data-science-driven underwriting platforms in our previous company — the same discipline now powers how we manage risk and discover opportunity.

We’re millennials who speak your language, have faced your challenges, and are building solutions that reflect today’s investing reality — transparent, intelligent, and adaptive. We are confident of standing out in a sea of mediocrity very soon through our performance and communication. More on the Grey Sky Capital difference can be read here.

Q23. How can I get started? Book a short call. We are not here to force sell our product. We will see whether it suits you. We’ll walk you through the strategy, performance, and onboarding — without pressure. If it fits, great. If not, at least you’ll walk away clearer than before. Read about product presentation here.

9. NRI investing

Q24. Can NRIs invest in Grey Sky Capital PMS?

Yes, Non-Resident Indians (NRIs) are eligible to invest in Grey Sky Capital's Smart Core PMS. SEBI regulations permit NRIs to participate in Portfolio Management Services through their NRE or NRO accounts with a SEBI-registered custodian. A separate bank, dmat and trading account needs to opened. Any existing NRE Portfolio Investment Account (PINS) with a bank other than HDFC Bank must be closed and the balance has to be moved to the new HDFC Bank account.

Our team assists NRI investors with the onboarding process, documentation, and compliance requirements to make getting started seamless. We don't support NRIs from US/ Canada as they face additional compliance and tax related aspects.

⚖️ Regulatory Disclaimer

Grey Sky Capital Private Limited is registered with SEBI as a Portfolio Manager under the SEBI (Portfolio Managers) Regulations, 2020. Investments in securities are subject to market risks. Past performance does not guarantee future results. Please read the Disclosure Document carefully before investing.