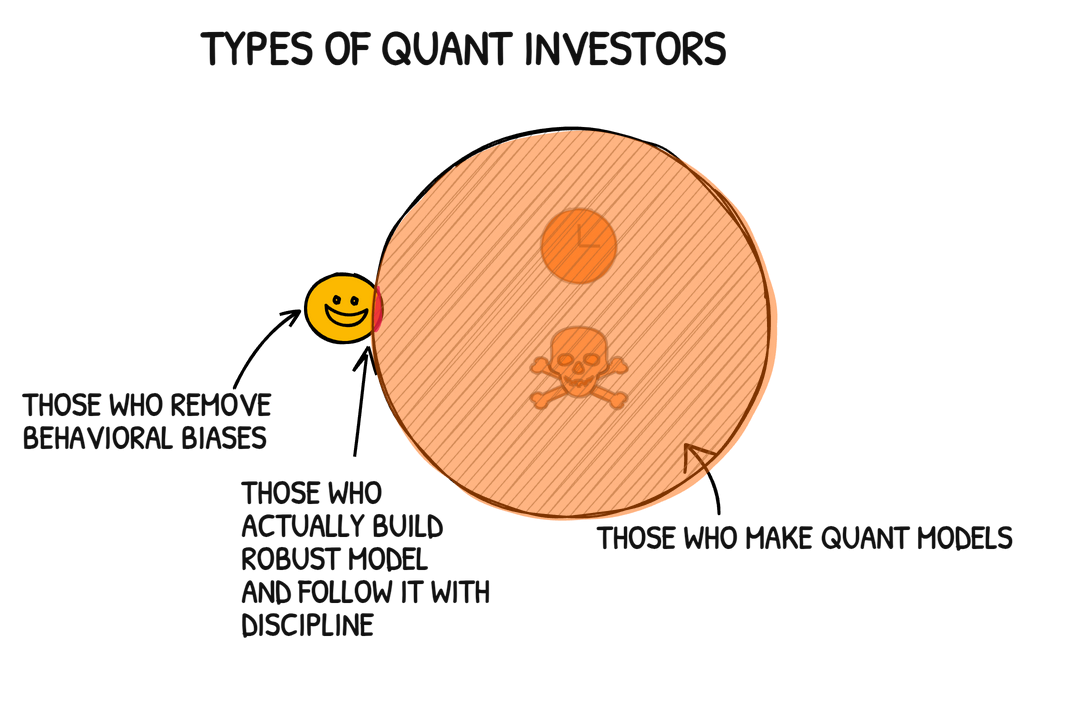

Quant investing fails when humans take the wheel

Our emotions, biases, and impulses are often the biggest threats to long-term returns. We hold losers too long and sell winners too early. Behavioral finance has a long catalog of these mistakes—and most of us have made them.

Quantitative investing was supposed to solve a big problem in investing: us.

Our emotions, biases, and impulses are often the biggest threats to long-term returns. We panic when markets fall. We chase what's hot. We avoid necessary risks. We hold losers too long and sell winners too early. Behavioral finance has a long catalog of these mistakes—and most of us have made them.

Quant strategies emerged as a response to this very human problem. They’re built to be rules-based, data-driven, and systematic. The idea is simple: remove emotion, enforce discipline, and let the math do the work.

But in recent years, something strange has happened.

The Democratization of Quant—and Its Hidden Pitfalls

Quant investing has become more accessible than ever. Today, platforms let retail investors access algorithmic strategies, factor-based portfolios, and rules-based stock screens with just a few clicks. It’s all available—often under the banner of “do-it-yourself” investing.

On the surface, this sounds like progress.

But in practice, we may just be reinventing an old problem in a new form.

The Return of Investor Bias

When quant strategies are delivered in DIY format, the behavioral issues they were designed to eliminate start to creep back in:

- Investors stop following the system when performance dips

- They add capital at the top and pull out at the bottom

- They jump between strategies, chasing recent winners

- They override or pause the model based on gut instinct

This isn’t theoretical. Study after study shows that investor returns often lag behind strategy returns—not because the models fail, but because investor behavior undermines them.

Even the most robust quant model can’t protect itself from human second-guessing. All the gains are lost to making investors feel good about themselves.

The Autopilot Analogy

Imagine a commercial airliner on autopilot: it’s managing altitude, course corrections, and fuel efficiency—even navigating turbulence. Now imagine the passengers are handed the controls mid-flight.

That’s what DIY quant investing often looks like. The system is in place. The path is optimized. But a human hand on the wheel can still send it off course.

Discipline Isn’t Just in the Model—It’s in the Structure

The real power of a quant strategy isn’t just in the algorithm. It’s in the governance—how it's executed, monitored, and maintained.

At Grey Sky Capital, we believe that successful quant investing requires two things:

- Smart systems, grounded in data and rigor

- Structural discipline, that prevents emotion from interfering with execution

That means:

- No human discretion in day-to-day trades

- Systematic rebalancing and rule adherence

- Staying the course during stress and volatility

- Letting the system do what it was built to do—compound over time

In short: a good system isn’t enough. It has to live in a good structure.

Final Thought

The irony of modern quant investing is that it’s increasingly delivered in ways that reintroduce the very behaviors it was built to eliminate.

If we want quant outcomes, we need more than quant thinking—we need disciplined structure.

At Grey Sky Capital, that’s our mission: Smart systems, executed with discipline, to deliver long-term results