Why we started Grey Sky Capital

Personal finance is not taught in schools or colleges. Timeless principles of compounding, asset allocation, difference between wealth builder and income generator were learnt over time.

A calm, risk‑managed path to compounding for India’s mass affluent.

- Quant, risk-managed PMS for India’s mass affluent

- Dynamic allocation across equity, debt, gold with strict drawdown controls

- Built for alignment, transparency, and long-term results

🔗 Join the Founders' Circle — Start with a 20‑min intro conversation.

It started with a few simple questions about where we could have done better in life. We studied hard, went to prestigious colleges, landed decent gigs, rose through the ranks, did well monetarily, had access to most good things modern life had to offer.

But what we could have done better ?

Apurv and I didn’t let our money work as hard or smart as we did.

Like many professionals, we went through phases — each shaped by income, ambition, energy and a few painful but useful lessons.

Our mistakes

Phase 1: The trading mirage

In the early years of my job, full of energy and ambition, like many I also dabbled in trading. A right call felt like genius; a wrong one felt like bad luck. But over time, I realised this wasn’t compounding – it was gambling dressed up in spreadsheets.

I have written about the pitfalls of it so many times on my LinkedIn posts.

I was going up against full-time traders and algorithms while juggling a demanding career. It was unfair to both my current career and trading.

Like most retail traders, I lost more than money. I lost time, focus, and trust in the system.

Phase 2: The illusion of safety

Scarred by markets, I turned to real estate. It felt tangible, safe, sensible. Except it wasn’t. It was a leveraged bet, with poor liquidity and ultimately low yield.

For years, I worked to repay loans on assets that did little for my wealth. Eventually, the loans were repaid — but the compounding clock had barely moved.

Phase 3: Search for peace of mind in wealth

A few years later, life felt stable. I was earning well, saving ₹8-10 lacs a month and wanted peace with respect to my investments. I didn’t want to juggle dozens of funds, advisors, or schemes. I wanted my capital to work as hard as I did.

What I sought was simple, yet rare; a trusted partner who could:

- Stay true to label, no hidden risks, no fancy stories. Reliability had to be high.

- Offer a transparent, aligned fee structure. Integrity cannot be compromised.

- Be top-decile over the cycle, not just a lucky year. Performance is paramount.

I was ready to hand over the reins — but the market offered few who truly fit that mold. I never believed in the DIY approach. Wealth deserves professional attention, not weekend experiments. I disliked cheap 'index-hugging' active solutions that charged 50 bps for mediocrity. I looked for value for money, not 'low cost at any cost'.

But the more I searched, the more I realised – the middle ground barely existed. Those who inspired trust catered to ultra-HNIs or family offices. For the rest of us, there was a void.

So, the money stayed idle — sitting in savings accounts and fixed deposits, quietly eroded by inflation and taxes.

It felt ironic: despite years of hard work, my wealth wasn’t compounding meaningfully and peacefully.

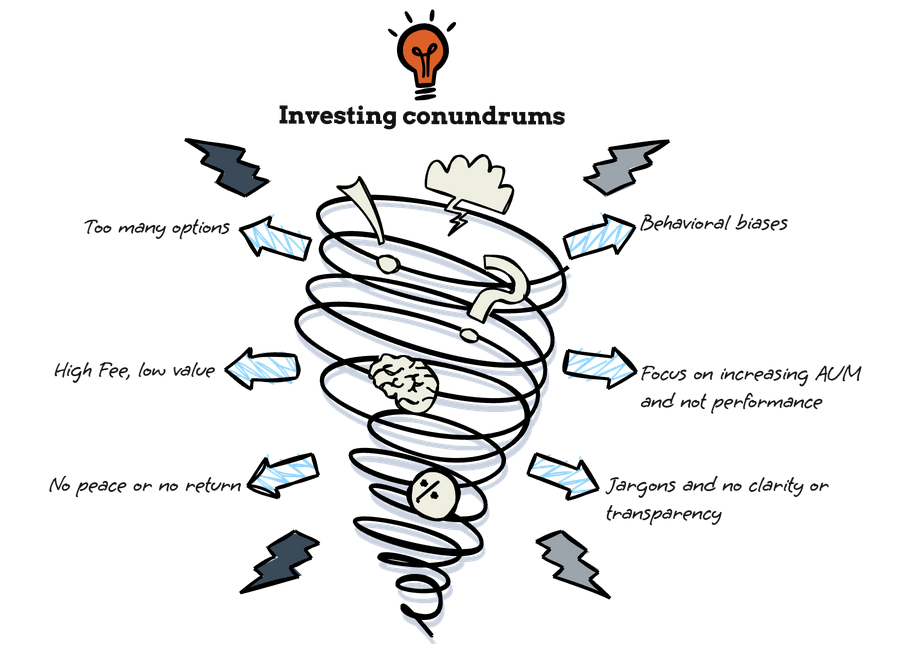

The mass affluent problem

That’s when it became clear: I wasn’t the only one.

There’s a silent, underserved class of investors — professionals, founders, senior executives — with financial assets between ₹50 lakh and ₹10 crore.

The mass affluent.

They’ve built wealth the hard way and early in life, but remain under-equipped in personal finance. They are offered index hugging products, high fee structures with low conviction, poor transparency or worse, disguised risk.

Most tragically, they’re forced to do it alone.

Side-trading. Portfolio hopping. Asset misallocation.

Not because they’re reckless — but because no one built for them.

That’s why we started Grey Sky Capital – to challenge the old guard, to fix what’s broken and to bring institutional-grade investing to those who’ve earned it and deserve better.

What is Grey Sky Capital?

Grey Sky Capital is an asset manager for those who don’t just want to protect their capital — they want to build something with it.

We are serious capital allocators, passionate about the power of compounding and radically committed to transparency, trust and continuous improvement

We have scaled businesses and managed large corpus of funds in the past. We understand what is takes to deliver performance while keeping the customer first and manage risk.

We are building for the future of Indian wealth: data-led, institutional-quality.

“Performance with integrity and reliability.”

The Smart Core Portfolio

- Dynamic equity, debt, gold mix

- Strict drawdown controls

- Transparent, aligned fees

- Category: Multi-asset PMS

- Focus: Large & Midcap equities, debt, gold

- Goal: Outperform benchmarks with drawdown control

- Fit: Core 50%+ of a serious investor's potfolio

- Mass affluent with ₹50L–₹10Cr of financial assets

- Busy professionals and founders

- Prefer risk-managed, data-driven wealth creation

Our first offering — the Smart Core Portfolio — is the wealth compounding engine we wish we had a decade ago.

- Smart Core is your natural home. Designed to be the everything you need from creating wealth to minimising drawdowns.

- Its crafted for your long term needs. If you’re here to speculate or switch at every correction, this isn’t for you. We’re not built for everyone — only for those who value process over prediction.

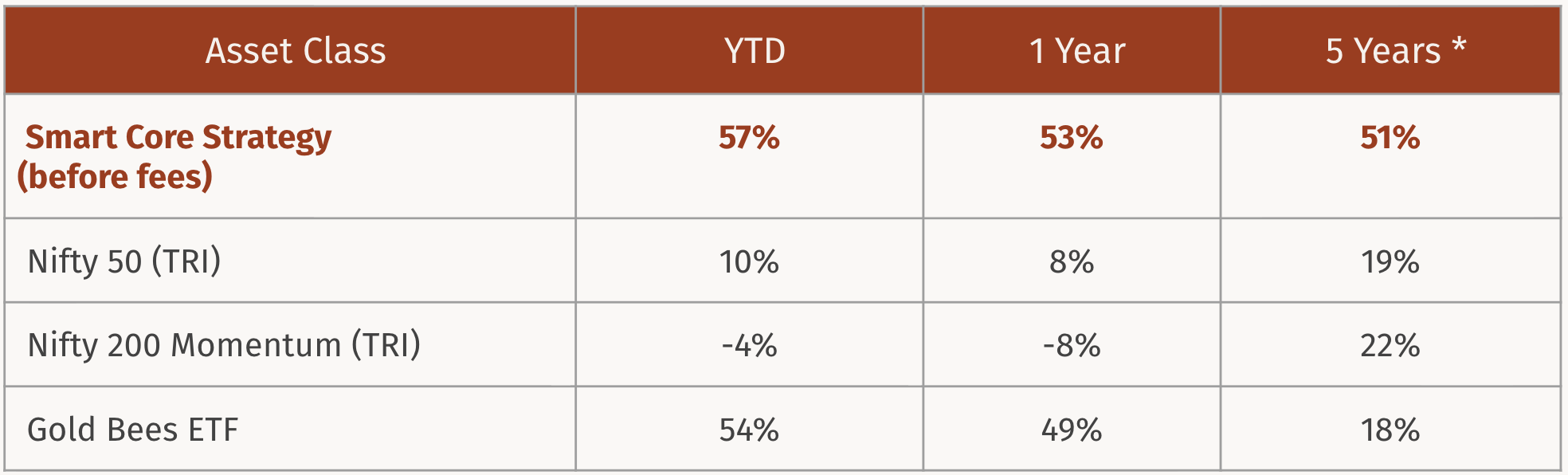

- It’s designed to beat any fixed (or 100%) asset class allocation over 5 years. Below are the backtested results for the model.

Backtested returns disclaimer

Returns as on 31st October, 2025. Backtested returns are not adjusted for fees. Strategy is fully quant-driven, back-tested over 11 years using walk-forward methodology. Free of look ahead bias and survivorship bias. The performance results presented herein are hypothetical and based on a model portfolio constructed by Grey Sky Capital. These results are provided for illustrative purposes only and do not reflect actual trading activity or client accounts.

If your financial assets are between ₹50 lakh and ₹10 crore, this could be the only product you need to build wealth sensibly. If you’re an HNI or UHNI, this can be the core 50%+ anchor of your portfolio. It’s being offered under a PMS structure, and we’ve just received our SEBI license to operate as a Portfolio Manager.

If you know Apurv or me personally, you already know what we stand for — reliability, integrity, and performance. We wouldn’t bring anything to market that we wouldn’t invest our own money in. At Grey Sky Capital, excellence isn’t a pitch, its our basic filter. If it’s not good enough for us, it’s not good enough for you. Its a product crafted by us, for people like us.

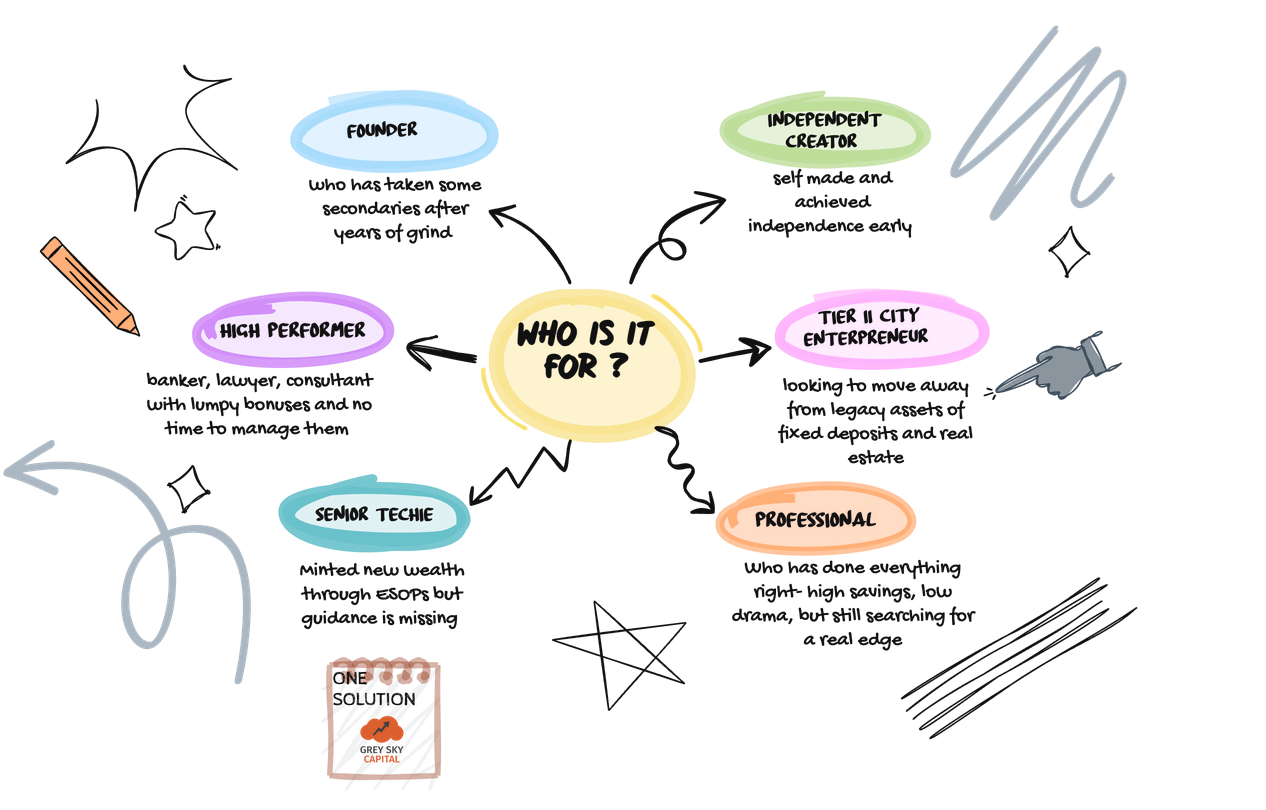

This is for you, If you’ve earned it the hard way

You might be:

- A founder who’s taken some secondaries after years of grind

- A banker, lawyer, or consultant with lumpy bonuses and no time to manage them

- A senior techie, product lead, or engineer with ESOPs and little guidance

- A professional who's done everything right — high savings, low drama, but still searching for a real edge

- A tier II city entrepreneur looking to move away from legacy assets.

If that sounds like you, you’re exactly who we built Grey Sky Capital for.

You’ve worked hard, saved hard, and want your money to work just as hard — with clarity and conviction.

The Founders' Circle

We’re not building a mass-market product. We have built it for people like us.

We’re building a high-touch, high-integrity firm — one that values relationships as much as returns.

In our first two years, we’ll work with no more than 1000 clients. We want to know each of them — their stories, goals, aspirations — and grow together.

Right now, we’re inviting our first 100 clients into what we call the Founder’s Circle. Over 40 seats are already spoken for.

When you join, you’re not just entrusting us with your capital. You’re joining a community of thoughtful professionals, builders, and creators — people who think long-term and act with intent.

👉 If you’d like to know more about the product or have a conversation, you can sign up for the Founder’s Circle.

Join the Founders' Circle - Start with a 20-min intro conversation.

Let’s build something exceptional, together.

Shobhit Agarwal & Apurv Anand

Founders, Grey Sky Capital