Skin in the game

We only get paid when you do better than the market.

We only get paid when you do better than the market.

The Problem

Most investment managers win even when you lose.

They charge fixed fees regardless of performance — and take a cut of returns even if you just matched the benchmark.

That’s not alignment. That’s extraction.

The Grey Sky Way

Our fee structure is built on one principle: we earn when you outperform.

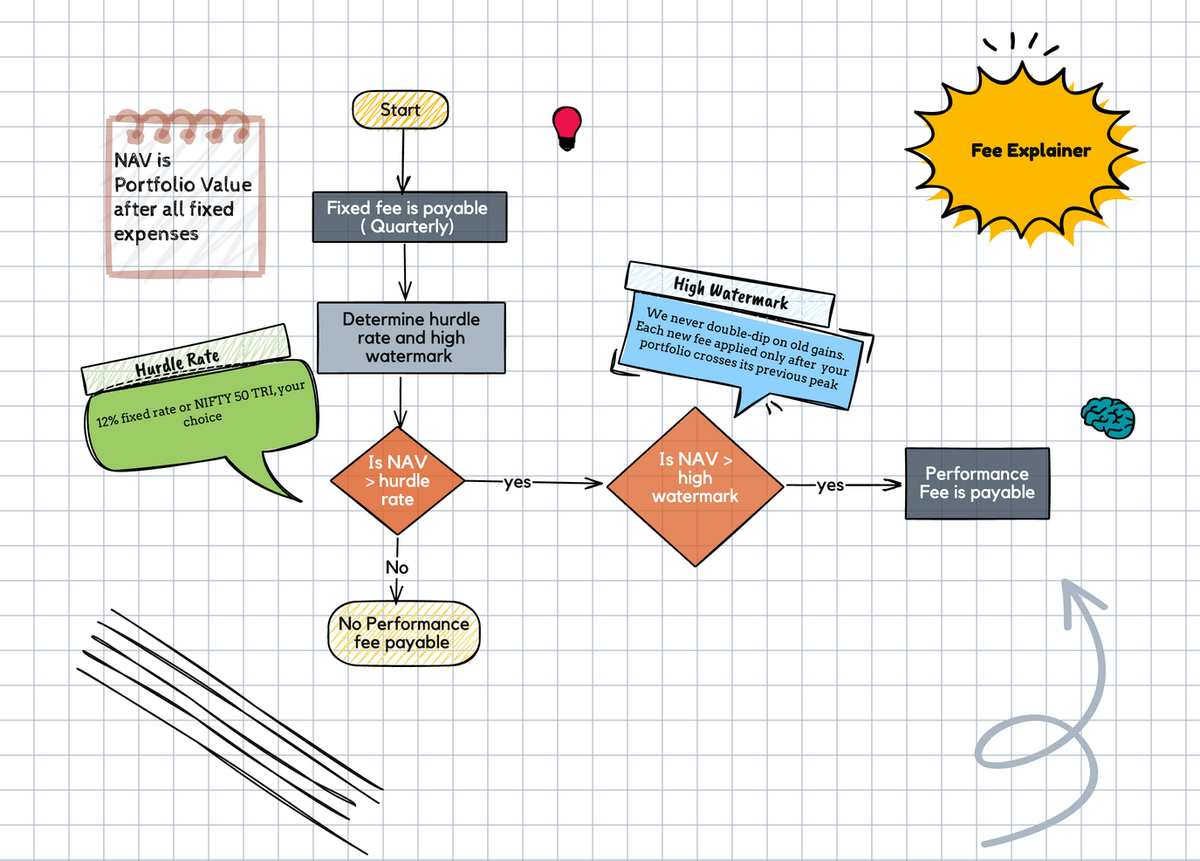

- Low Fixed Fee: A minimal base cost of 0.75% p.a. — just enough to cover operations.

- Performance Fee Only on Alpha: You pay only when returns exceed the benchmark and high water mark. 20% of the gains over hurdle rate.

- High-Hurdle Rate: We are giving option to investors to chose a high hurdle rate of 12% p.a. ( fixed) or Nifty 50 TRI. We will be one of the rarest PMS to offer this high hurdle rate.

- No Performance Fee in Negative Years: If we don’t create wealth, we don’t participate.

- High-Water Mark: We never double-dip on old gains. Each new fee applies only after your portfolio crosses its previous peak.

Check out our intuitive fee simulator below

Why It Matters

This isn’t marketing fluff. It’s structural integrity.

Every clause forces us to stay disciplined, data-driven, and long-term focused.

We only win when you do — and we win together.

The Result

Investors get transparency.

We get accountability.

The market gets a new standard for fairness.

One fee structure for everyone for the same product. No looking over shoulder on who is being charged what.

You can download the illustrative fee calculator from here.

Or, just use this link! https://greysky.capital/fee-simulator/